Your bank account number is one of the most important details tied to your finances. It’s what you use to set up direct deposit, pay bills, transfer money, or receive funds. From online payments to linking apps like Venmo or PayPal, this number makes everyday banking possible.

Unlike your debit card number, which can be replaced if lost, your bank account number stays with you unless you open a new account. That’s why it’s important to know exactly where to find it and how to use it securely. Here’s what you need to know.

Where can I find my bank account number?

There are various ways to locate your bank account number such as on checks, bank statements, through online banking, or by contacting your bank directly.

1. On Your Checks

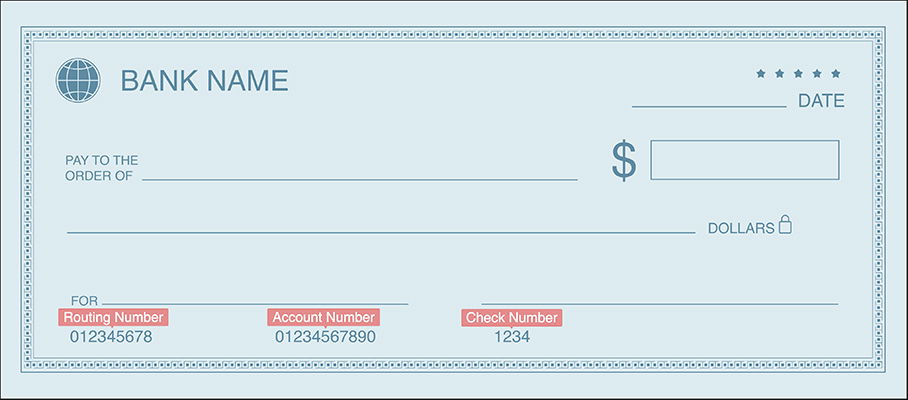

One place you can find your checking account number is on your checks. It’s typically located on the bottom of the check. You will also see other identifying information like your bank’s routing number and check number.

2. On Your Bank Statement

Your bank account number can also be found on your bank statement. It’s usually near the top, accompanied by other relevant information such as your account balance and the statement period.

Electronic bank statements can typically be accessed via the bank’s website after logging in with your credentials and reviewing the account summary.

3. Your Bank’s Website or Mobile App

You can also find your bank account number online by logging in to your bank’s website using your username and password. Upon successful login, you’ll be able to see a summary of your account which will prominently display your account number.

If you prefer using your bank’s mobile app, the information can also be found there. However, you may need to do some exploring to locate it.

4. By Contacting Your Bank

If you’re still unable to find your bank account number, don’t worry. You can always get in touch with your bank for assistance. This can be done by calling, visiting a branch, or sending an email. A friendly representative will be glad to assist you and help you locate your account number.

Account vs. Routing Number

When it comes to personal banking, it’s helpful to understand the difference between an account number and a routing number.

Account numbers identify your personal account while the routing numbers identify the bank responsible for transactions.

Routing numbers are nine-digit codes used by financial institutions to process electronic transfers, like direct deposit or wire transfers. They are assigned by the Federal Reserve and are unique to each financial institution.

On the other hand, your account number is a unique identifier assigned to you by your bank and is used to identify your specific account.

It’s important to correctly enter both the bank routing number and account number when making transactions, as incorrect information may result in delayed or rejected transfers.

How to Use Your Bank Account Number

Bank account numbers can be used in many ways. We will cover setting up automatic payments, making online transfers, and direct deposit of paychecks.

Setting up Automatic Payments

Having your checking account number is essential if you want to set up automatic payments. With this information, you can ensure that your bills, such as utilities, rent or mortgage, and credit cards, are paid on time without having to manually write and mail checks or make online payments each month.

To set up automatic payments, you will need to provide your account number, routing number, and the payee’s information, like their name and address.

Making Online Transfers

Bank account numbers are also necessary for making online transfers, such as transferring funds between your own accounts or to another person’s account. This can be done through online banking, a mobile banking app, or through the bank’s website.

To make an online transfer, you will need to your account number and routing number. You’ll also need the recipient’s account number, along with their name and the bank where the account is held.

Direct Deposit of Paychecks

Direct deposit is a convenient and reliable way to receive your paychecks, Social Security benefits, or other forms of income. You can easily set up direct deposit with your employer by providing them with your account number and routing number.

With direct deposit, you no longer need to wait for a check to clear or visit the bank to deposit it. Instead, the funds are securely deposited into your account as soon as they are processed. This saves you time and effort, and makes managing your finances much easier.

Frequently Asked Questions

Why is it important to know your bank account number?

You’ll need it anytime you set up direct deposit, make a wire transfer, or pay a bill from your account. It also helps verify your identity when accessing account services online or by phone.

Can I use my bank account number for online transactions?

Yes. It’s commonly used for online transfers, paying bills, setting up subscriptions, or linking accounts to apps like PayPal or Venmo.

Can I change my bank account number?

In some cases, yes—usually if there’s fraud or another serious issue. You’ll need to contact your bank to request a new number and open a new account.

Is it safe to share my bank account number?

It’s safe to give your number to a trusted source for things like direct deposit or bill payments. But never share it with someone you don’t know or trust. Always verify who’s asking.

Can I find my bank account number on my debit card?

No. Your debit card has its own number, which is different from your bank account number.

How many digits is a bank account number?

It varies by bank but typically ranges from 8 to 12 digits. Some banks use even longer numbers.

Leave a Reply