Author: MoneyMaven

-

8 Reasons Silver Divorces Are On The Rise

Family or Marriage Image Source: pexels.com Divorce isn’t just a young person’s game anymore. In recent years, the rate of “silver divorce”—the term for couples splitting up after age 50—has surged, catching many by surprise. If you’re in midlife or beyond, you might be wondering why so many long-term marriages are ending just as retirement…

-

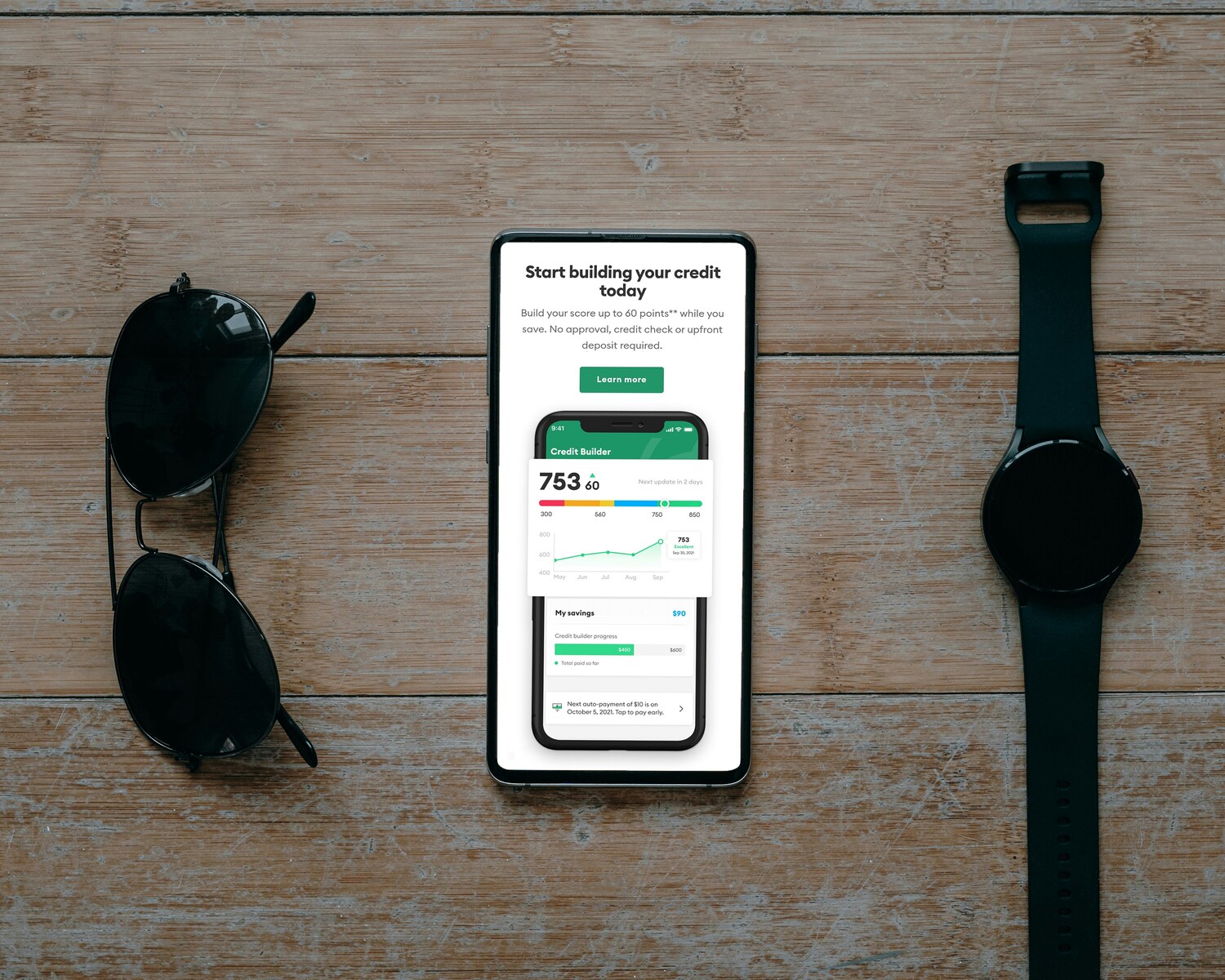

5 Eye-Opening Facts About Credit Reports

Image source: Unsplash Your credit report may be one of the most important documents in your financial life, but it’s also one of the most misunderstood. Most people only think about their credit when applying for a loan or getting denied for a credit card. But in reality, your credit report plays a role in…

-

8 Best Personal Loans for Veterans with Bad Credit of 2025

If you are a veteran with bad credit, finding a personal loan can feel impossible. But options do exist. While there is no official personal loan program just for veterans, some lenders offer more flexible terms for military borrowers and their families. Many credit unions also provide special benefits for veterans, with lower interest rates…

-

The Middle Class Can’t Keep Up—Here’s Where Their Money Is Really Going

Financial Education My family is considered to be in the middle class these days, which is a far cry from being homeless and living in a motel just eight years ago. That said, the American middle class is feeling the squeeze. Most of us are working full-time jobs (and even have two-income homes), but our…

-

9 Surprising Health Benefits of Financial Stability

Image source: Pexels When we think about health, we usually picture gym memberships, balanced meals, and maybe a few extra steps in our skincare routine. But there’s another, often-overlooked factor that plays a huge role in our overall well-being: financial stability. Yes, having your finances in order can do far more than ease the stress…

-

5 Best Home Equity Loan Lenders of June 2025

If you own a home, you may have equity that can be turned into cash for big expenses like home renovations, debt consolidation, or unexpected costs. A home equity loan lets you borrow a lump sum, using your house as collateral, with fixed monthly payments and interest rates that are often lower than personal loans…

-

Should You Break Up Before Moving in Together? Here’s Why You Might Want To

relationship When my wife and I moved in with each other nearly nine years ago, it was kind of a spur-of-the-moment decision. Neither of us put a ton of thought into it, but we knew we wanted to be together. However, moving in together can significantly magnify problems that might have been easier to ignore…

-

How Much You Really Need and How to Save It

Image source: Pexels An emergency fund is your financial safety net. It’s the money you set aside before disaster strikes…not after. Whether it’s a job loss, medical emergency, car breakdown, or unexpected home repair, having accessible savings can prevent you from spiraling into high-interest debt or financial panic. Too often, emergencies become catastrophes not because…

-

What It Is and How to Avoid It

Paying off your mortgage early sounds like a smart financial move. Who wouldn’t want to save on interest and get out of debt faster? But some lenders may hit you with an unexpected fee if you do. It is called a mortgage prepayment penalty—and it can cost you thousands of dollars if you are not…

-

10 Things Men Regret Waiting Too Long to Apologize For

relationship Apologizing doesn’t come naturally for everyone. It’s not because the person doesn’t feel regret about whatever happened, but it can be difficult to admit when you’re at fault. That said, many men regret waiting too long to say those two words: “I’m sorry.” Here are 10 things men apologize for, but realize it might…