Author: MoneyMaven

-

Upgrade Review for 2025: Checking and Savings Accounts

Upgrade offers no-fee banking with high-value perks—like 4.02% APY on savings and up to 2% cash back on everyday debit card purchases. It’s built for people who want to grow their money without dealing with hidden charges or complicated rules. With a fully online setup and accounts managed through an easy-to-use mobile app, Upgrade cuts…

-

5 Red Flags When Buying a Used Car

Cars Image Source: 123rf.com The average price of a used car in the United States sits between $25,000 and $26,000. While this can be cheaper than buying something brand new, you should be careful before moving forward with your purchase. There are some blaring red flags that signal a lemon or, at the very least,…

-

These products will cost more because of tariffs

President Trump’s tariffs have come into effect and we will likely start seeing products get even more expensive as companies pass long these costs to consumers. All goods coming into the country will have a minimum 10% tariff, with some countries seeing higher rates. On April 9th, everything coming from China will have a 54%…

-

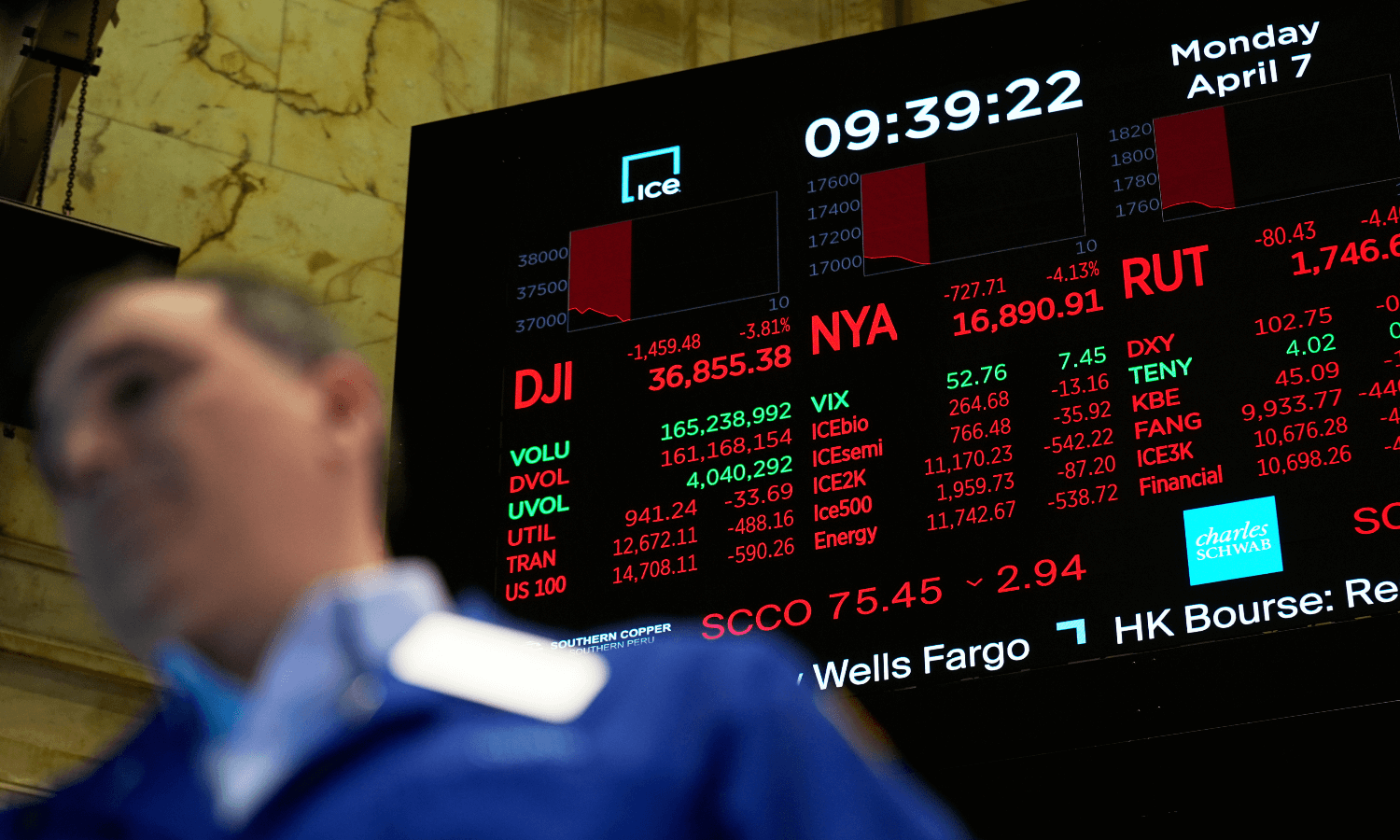

How to stay the course with your retirement plan during market volatility

Keep calm and avoid panic selling Michael Pate, senior portfolio manager at Wellington-Altus Private Wealth Inc., says he’s been helping calm clients and reminding them that a balanced portfolio means they’re not taking the brunt of the equity losses in the news. “It’s just a matter of talking them off the ledge and reminding them…

-

Why Financial Anxiety Is So Common—And How to Finally Feel in Control

Image by Alexander Grey of Unsplash If you’ve ever hesitated to open your bank app or delayed checking your credit card balance, you’re far from alone. Financial anxiety is something most people experience at some point in their lives, and for many, it lingers in the background of daily decision-making. It doesn’t matter how much…

-

Why Men Are Buying Project Cars Again—And Loving Every Minute

Automotive Image Source: 123rf.com There’s something undeniably alluring about a project car. The idea of buying a car that’s seen better days and restoring it to its former glory—or making it even better—seems to have a magnetic pull on many men. While the trend may have faded a little in the past couple of decades,…

-

OnePay: New Account $125 Bonus

One Finance recently rebranded to OnePay and are now offering a $125 cash bonus through Rakuten. OnePay is a fintech company that works with Coastal Community Bank and Lead Bank (both Member FDIC) to offer banking services. They offer OnePay Cash, which comes with a debit card that offers cash back, no monthly fees, and…

-

How should young Canadians invest in bonds?

Orlic agrees in that “there’s nothing wrong with using an ETF to get exposure to a certain area like the bond market.” However, considering all that’s happening in the economy right now with tariffs, interest rates and inflation, she said a bond mutual fund might not be a bad idea. “There’s a lot of moving…

-

9 Sneaky Ways To Save Money When Your Spouse Is An Impulsive Buyer

Image Source: 123rf.com Let’s be honest—living with someone who loves to shop “just because” can turn your monthly budget into a hot mess. Whether it’s late-night Amazon hauls or spontaneous splurges at Target, an impulsive spender can make it feel like you’re constantly playing financial cleanup. But here’s the deal: you don’t have to become…

-

Current Mobile Banking Review for 2025

Tired of overdraft fees and waiting days for your paycheck to hit? Current offers early direct deposit, up to 4.00% APY on savings, and instant gas hold removals—all without monthly fees or credit checks. Whether you’re managing everyday spending, saving for short-term goals, or setting up a teen with their first debit card, Current packs…