Even though tax liens no longer show up on your credit report, they can still wreck your finances if you ignore them. If left unpaid, the IRS can seize your bank account, garnish your wages, or take your home or business property.

That means tax liens are still a serious threat, even if they don’t hurt your credit score directly. And if one still appears on your credit report by mistake, you have the right to get it removed.

This guide explains what a tax lien actually is, how it affects your finances, and what to do if one shows up on your credit report. You’ll also learn how to pay off or resolve a tax lien—and when it makes sense to get professional help.

What is a tax lien?

A tax lien is the government’s legal claim to your property when you owe back taxes. If you don’t pay your federal or state tax bill, the IRS or your state’s tax agency can file a lien, giving them priority over your assets.

There are two main types of tax liens:

- Federal tax liens are filed by the IRS and can apply to everything you own—your home, car, bank accounts, and even future assets.

- State tax liens work the same way but are filed by your state’s tax authority. These are also recorded in public records and can limit your ability to sell property or get new credit.

Common reasons for tax liens include unpaid income taxes, self-employment taxes, business payroll taxes, or failing to respond to IRS notices. If the debt stays unpaid, the lien may eventually turn into a levy—where the government takes your assets directly.

Do tax liens still affect your credit report?

As of April 2018, tax liens were officially removed from all consumer credit reports. This change was made by all three major credit bureaus—Equifax, Experian, and TransUnion.

Because tax liens are no longer included in your credit reports, they don’t impact your credit score. However, that doesn’t mean lenders won’t find out about them.

Tax liens are public records. Even though they don’t show up on your credit report, mortgage lenders, business creditors, and other financial institutions can still search public databases and see that a lien exists. That can make it harder to get approved for new credit, especially for large loans like mortgages.

Ready to Clean Up Your Credit Report?

Learn how credit repair professionals can assist you in disputing inaccuracies on your credit report.

Why a Tax Lien Is Still a Serious Financial Risk

Even though a tax lien won’t drag down your credit score, it can still cause serious financial problems if you don’t deal with it.

- Your assets are at risk: The government can seize your car, your house, your bank account, or other valuable property if you ignore the debt.

- Your paycheck can be garnished: If the IRS turns the lien into a levy, they can legally take part of your wages until the debt is paid.

- Your business could suffer: If you run a business, a lien can apply to your inventory, equipment, or even your customer payments (accounts receivable).

- Lenders may turn you down: Even without a credit score hit, a tax lien can be a red flag for lenders who review your financial background.

- Bankruptcy won’t wipe it out: Tax liens often survive bankruptcy, which means they’ll still be there even after your other debts are cleared.

A tax lien is more than just a note in the system—it’s a legal claim that can follow you until it’s resolved.

How to Remove a Tax Lien From Your Credit Report

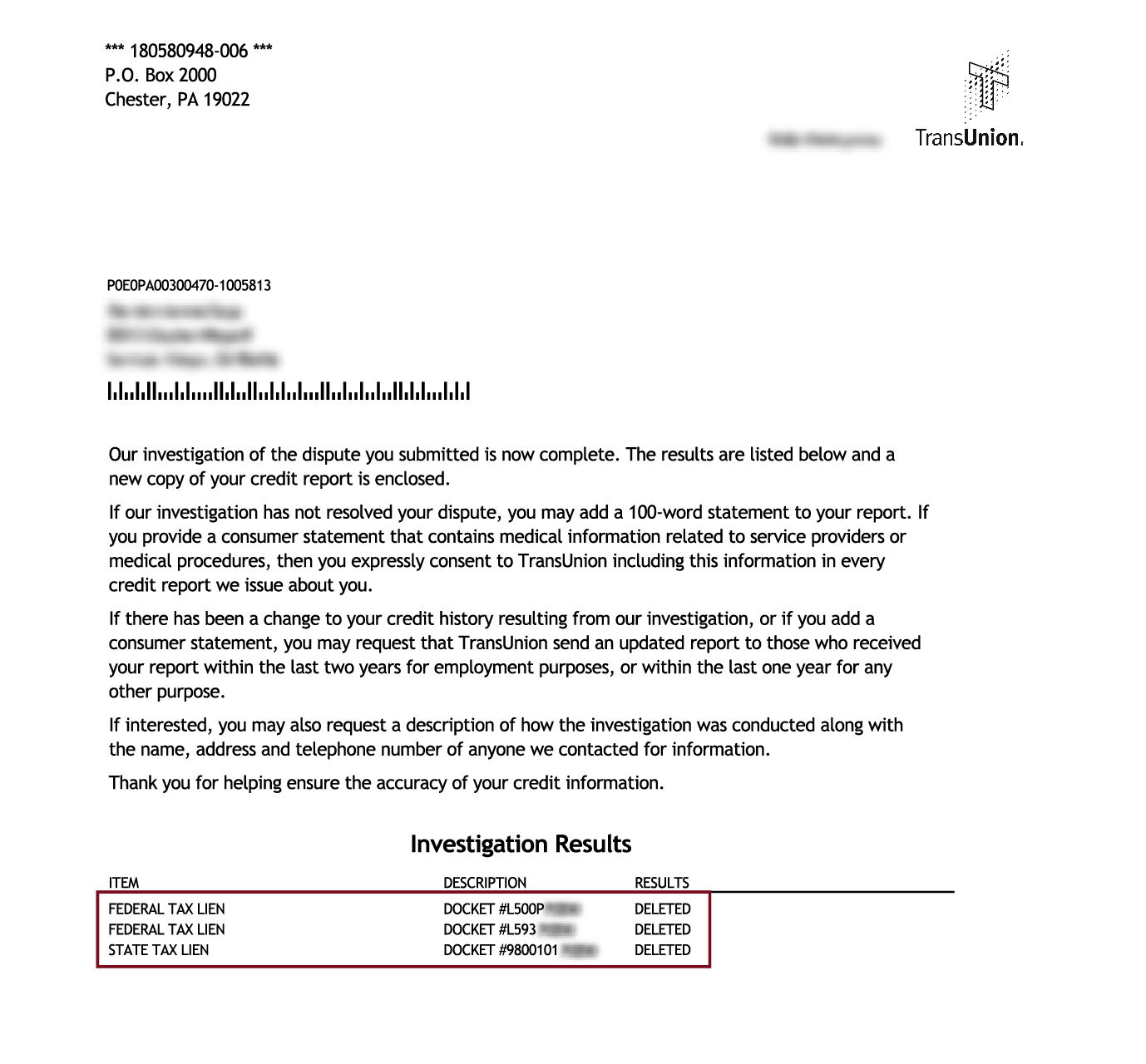

If you still see a tax lien on your credit report, it shouldn’t be there. All tax liens were removed from credit reports in 2018, so any that still appear are inaccurate.

You have the right to dispute any incorrect information under the Fair Credit Reporting Act. Here’s how to get started.

Check Your Credit Reports

Start by requesting your credit reports from all three major credit bureaus—Equifax, Experian, and TransUnion. You can get them for free at AnnualCreditReport.com.

Review each report and look for any mention of a tax lien. If you find one, note which bureau is reporting it.

File a Dispute With the Credit Bureau

You can dispute the lien online through the credit bureau’s website or by mail if you want a paper trail. Make sure to include supporting documentation, such as:

- A copy of your IRS lien release

- A letter from the IRS confirming the lien was paid or withdrawn

Once you file the dispute, the credit bureau has 30 days to complete its investigation. If they confirm the lien is inaccurate or outdated, it must be removed from your report.

What to Do If Your Dispute Is Denied

If the credit bureau refuses to remove the lien, you still have options:

- Add a statement of dispute: This gives you a chance to explain the situation in your own words. It won’t fix the error, but lenders will see your note when reviewing your credit.

- File a complaint with the CFPB: If you’ve provided proof and the bureau still won’t correct the error, submit a complaint through the Consumer Financial Protection Bureau.

How to Pay Off a Tax Lien and Get It Released

The simplest way to get rid of a tax lien is to pay your tax debt in full. Once the debt is paid, the IRS will release the lien within 30 days.

If you can’t pay everything at once, the IRS offers two types of payment plans:

- Short-term payment plan – No setup fee. You’ll need to pay the full amount within 180 days.

- Long-term payment plan – Monthly payments over time. Requires a $31 setup fee if you agree to direct debit from your bank account.

You can apply online through the IRS Payment Plan page.

Once the final payment clears, the IRS will issue a lien release, which you can then use to confirm the debt is resolved if any issues come up later.

Can you get a tax lien withdrawn?

There’s a difference between a lien release and a lien withdrawal:

- A lien release means the tax debt has been paid and the IRS no longer claims your property.

- A lien withdrawal means the IRS removes the lien from public record as if it was never filed.

Withdrawal is harder to get, but it’s possible through the IRS Fresh Start Program. You may qualify for withdrawal if:

- You’ve paid your full tax debt and requested the withdrawal using IRS Form 12277.

- You’re on a direct debit installment agreement and have made three consecutive on-time payments.

A withdrawal gives you a cleaner slate because it erases the public record of the lien. That can help if you’re applying for a mortgage or trying to rebuild your financial reputation.

What to Do If You Can’t Afford to Pay Your Tax Debt

If paying your tax debt in full isn’t possible, the IRS offers programs that can help reduce or delay what you owe. Here’s how to explore your options.

Consider an Offer in Compromise

An Offer in Compromise (OIC) lets you settle your tax debt for less than the full amount. The IRS only accepts OICs if it believes you can’t reasonably pay the full debt based on your income, assets, and expenses.

You’ll need to complete IRS Form 656 and provide detailed financial information. Approval isn’t guaranteed, but if accepted, it can wipe out a portion of your balance.

Apply for Currently Not Collectible Status

If you’re facing serious financial hardship—like unemployment or a major medical issue—you may qualify for Currently Not Collectible (CNC) status. This temporarily pauses IRS collection efforts, including liens and levies.

You’ll still owe the debt, but the IRS won’t try to collect until your financial situation improves. Interest may continue to accrue in the meantime.

Explore IRS Hardship Programs

In some cases, the IRS offers temporary payment relief through partial payment plans or extended installment agreements. These options are available if you can pay something but not the full amount right now.

You can review your eligibility and apply directly through the IRS payment portal.

When to Talk to a Tax Resolution Specialist

If your tax situation is complicated—or you’re overwhelmed by the paperwork—it might make sense to work with a tax resolution specialist. These professionals can help you:

- File for OIC or CNC status

- Negotiate better terms for payment

- Communicate directly with the IRS on your behalf

Just be sure to research any company or representative before signing up. Not all tax relief companies are legitimate.

When to Hire a Credit Repair Company

Fixing credit report errors yourself is always an option. But for some people, getting help from a credit repair company can make the process faster and less stressful.

When It Makes Sense to Get Help

You may want to consider professional help if:

- You’re dealing with multiple errors across all three bureaus

- Your dispute was denied and you’re not sure what to do next

- You don’t have the time or confidence to manage the back-and-forth process on your own

What They Can Do for You

A reputable credit repair company will review your credit reports, identify inaccuracies, and file disputes with the bureaus on your behalf. Some also offer credit monitoring, score tracking, and personalized action plans.

They can’t remove accurate negative information—but they can help clean up mistakes faster and more effectively if you’re hitting dead ends on your own.

What to Watch Out For

Not all companies play fair. Avoid any credit repair service that:

- Promises to remove accurate items from your report

- Asks for full payment upfront

- Guarantees a specific credit score increase

Always check their reviews and make sure they comply with the Credit Repair Organizations Act (CROA).

Ready to Clean Up Your Credit Report?

Learn how credit repair professionals can assist you in disputing inaccuracies on your credit report.

Final Thoughts

A tax lien may not hurt your credit score, but it can still follow you in ways that matter—especially when you’re applying for a loan or trying to protect your assets. The most important thing you can do is stay proactive.

If something doesn’t look right on your credit report, challenge it. If you’re falling behind on tax payments, explore every option before the IRS takes action. Credit and tax problems don’t fix themselves, but there’s always a path forward if you’re willing to take the first step.

Frequently Asked Questions

How do I find out if I have a tax lien?

Tax liens don’t show up on your credit report, but you can check directly with the IRS by creating an account at IRS.gov. For state tax liens, you’ll need to check with your state’s Department of Revenue or search local public records.

Can lenders still see tax liens?

Yes. Even though tax liens aren’t on your credit report, they’re part of public record. Mortgage lenders and other creditors often run public record checks, especially during underwriting. A lien can still impact your ability to get approved.

What’s the difference between a tax lien and a tax levy?

A tax lien is a legal claim to your property when you owe taxes. A tax levy is the actual seizure of property—like taking money from your bank account or garnishing your wages. A lien is a warning; a levy is enforcement.

Will a tax lien ever fall off on its own?

No. Unlike some debts that age off your credit report, a tax lien stays in public records until it’s resolved. Paying it off or qualifying for a withdrawal is the only way to remove it from public view.

Can I buy a house if I have a tax lien?

It’s possible, but it’s very difficult. Most mortgage lenders will require you to resolve the lien or prove you’re in good standing with the IRS before approving the loan. A lien signals to lenders that the government has first claim on your assets, which is a major risk for them.

Leave a Reply