Your credit score is a key factor in obtaining a home loan. It represents your ability to repay your loan on time. A higher credit score can lead to better loan terms, lower interest rates, and a greater likelihood of loan approval.

While credit scores are important for all loans, VA loans are unique in that they allow veterans to receive home loans with lower credit scores than conventional loans. This is because the VA guarantees a portion of the loan, so lenders are more willing to offer favorable loan terms to Veterans with lower credit scores. As a result, VA loans can be an excellent option for those who may not qualify for conventional loans due to their credit scores.

Highlights

- VA loans allow veterans to qualify with lower credit scores compared to conventional loans due to the VA’s loan guarantee, which encourages lenders to offer favorable terms to veterans.

- Although the VA does not set a minimum credit score, most lenders require a score of at least 620. Some lenders may go lower, so it’s worth shopping around.

- Besides credit score, lenders also assess debt-to-income (DTI) ratio, credit history, and recent financial stability, with many aiming for a DTI ratio of 41% or lower.

- Veterans with low credit scores can still improve their eligibility by making timely payments, reducing debt, avoiding new credit applications, and checking for errors on their credit reports.

- If declined, applicants can work to improve credit, address lender feedback, and reapply, or explore other lenders with different credit requirements.

What is a credit score, and what do lenders look for?

A credit score ranges between 300 and 850 and indicates your creditworthiness. The higher your credit score, the more likely you will be approved for a loan. Lenders look at your credit score to determine the interest rate you will be charged, the loan amount you can borrow, and the loan term.

It is important to note that the VA does not act as the lender for VA home loans. They only guarantee the loan, so private lenders are still responsible for underwriting and approving it.

What is the minimum credit score for a VA loan?

Technically, there is no minimum credit score for a VA loan. However, most lenders set their own minimum credit score requirements for borrowers. Lenders typically want a minimum credit score of 620, but it is recommended to consult with multiple lenders to check their credit score requirements and get a better idea of what you can qualify for. Additionally, it is possible to get a free credit score check to identify areas for improvement and take proactive steps to enhance your creditworthiness.

It is important to note that there is a difference between a mortgage credit score check and a FICO check. A mortgage credit score check assesses the risk of default on a home loan, while a FICO score check is used for general credit assessment.

Minimum Credit Scores of Top VA Loan Lenders

Here is a table of the top 10 VA lenders by volume and their advertised minimum credit score for a VA loan. You can further compare by visiting our page on the best VA loan companies.

| Lender | Minimum Credit Score for VA Loan |

| Veterans United | 620 |

| Rocket Mortgage | 580 |

| Freedom Mortgage | 550 |

| United Shore Financial Services | 620 |

| Navy Federal Credit Union | Undisclosed |

| Pennymac Loan Services | 620 |

| LoanDepot | 620 |

| USAA | 640 |

| New Day Financial | Undisclosed |

| Fairway Independent Mortgage | 600 |

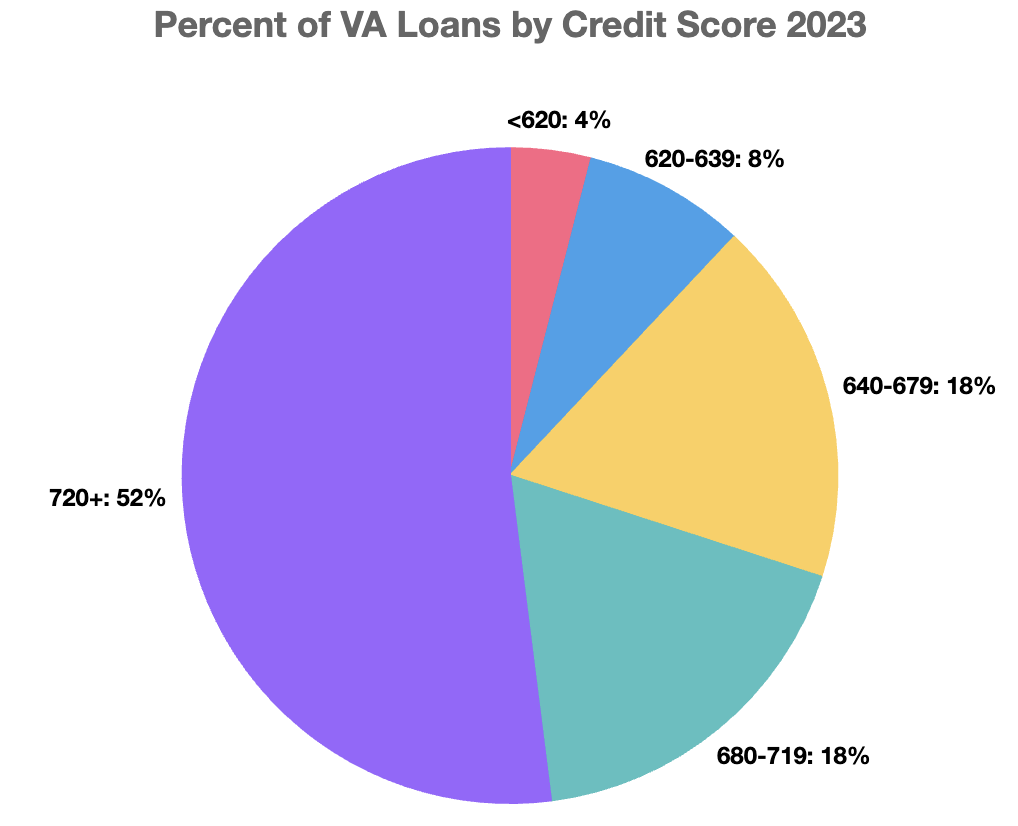

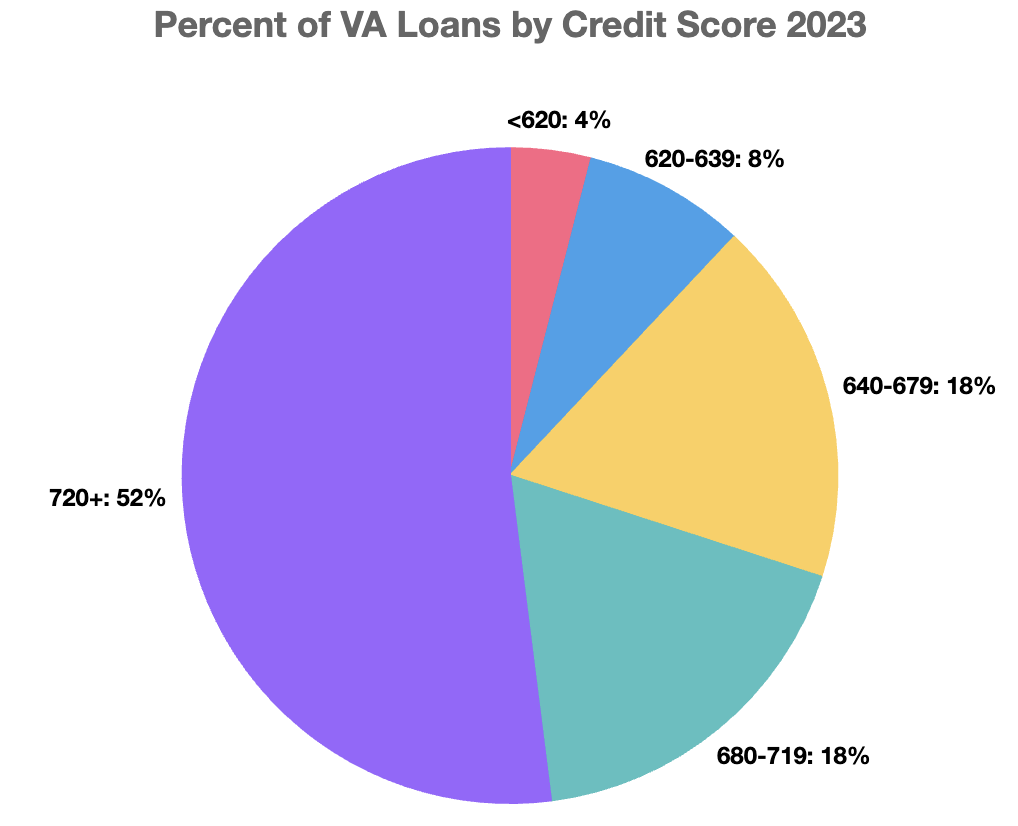

VA Loan Credit Scores 2023

Although the VA loan credit requirements are lower than conventional loans, Veterans with a variety of credit scores utilize VA loans. Here is a chart showing the percentage of approved VA Loans by Credit Score in 2023.

VA Loan Credit Requirements vs. Other Mortgage Options

To better understand how VA loan credit requirements compare to other mortgage options, here is a table that compares the credit score minimums of all major loan products.

| Loan Type | Credit Score Minimum | Caveats |

| VA Loan | None | Lenders may set minimum credit scores |

| FHA Loan | 580 | Lower scores may be considered with a higher down payment |

| Conventional Loan | 620 | Higher scores can result in better interest rates |

| USDA Loan | 640 | For low-income borrowers in rural areas |

Factors that Affect Your VA Loan

Credit scores are not the only factor determining whether you qualify for a VA loan. Understanding the factors that affect your VA loan is crucial for Veterans looking to become homeowners.

Debt-to-Income Ratio (DTI)

Your debt-to-income (DTI) ratio is another crucial factor that lenders consider when evaluating your loan application. Your DTI represents the percentage of the monthly gross income that goes toward paying your fixed expenses such as debts, taxes, fees, and insurance premiums.

Lenders use your DTI ratio as an indicator of cash flow to see what percentage of your income goes toward fixed costs. In general, lenders prefer to see a DTI ratio of 41% or less for VA loans. However, in some cases, you may still be approved with a higher DTI ratio if you have compensating factors, such as a higher credit score or significant cash reserves.

To calculate your DTI ratio, add up all your monthly debt payments, including credit card bills, car payments, and other loans, and divide that total by your gross monthly income. For example, if your total monthly debt payments are $1,500 and your gross monthly income is $5,000, your DTI ratio would be 30%.

Credit History

Lenders use your credit history to verify how well you have handled credit in the past. Although past performance is not always a predictor of future performance, it is a useful tool for lenders.

A few past blemishes may not impact your chances of getting a VA Loan, and it is important to remember that recent credit history carries more weight than older credit history. Therefore, cleaning up your credit history for several months before applying for a new loan is advisable if you have had recent credit issues. Having bad credit can also impact the interest rates and fees associated with a VA loan, so it’s crucial to compare options.

How to Improve Your Credit Score

Getting a VA loan with bad credit may be challenging, but it’s not impossible. If you have a low credit score, there are several steps you can take to improve it. Here are a few tips:

| Make payments on time | Late payments can significantly impact your credit score, so it’s crucial to pay your bills on time. |

|---|---|

| Keep credit card balances low | If you have credit card debt, try to keep your balances low compared to your credit limit. A high utilization rate can lower your credit score. |

| Don’t open too many new accounts | Opening several new credit accounts at once can hurt your credit score, so it’s best to avoid opening too many accounts within a short period. |

| Check your credit report for errors | Mistakes on your credit report can negatively affect your credit score, so it’s essential to check your report for errors and dispute any inaccuracies. |

| Keep old accounts open | Length of credit history is another factor that affects your credit score, so keeping your old credit accounts open can help improve your score. |

| Avoid collections and delinquencies | Collections and delinquencies can significantly damage your credit score, so avoiding them is essential. |

What do I do if my VA loan application is declined?

To increase your chances of getting approved for a VA Loan in the future, consider taking these steps:

- Request recommendations from the loan officer on improving your approval chances.

- Review your credit report for any errors or inaccuracies and dispute them if necessary.

- Pay off any outstanding debts and keep your credit card balances low.

- Pay your bills on time and avoid applying for new credit accounts.

- Build up your savings to show lenders that you are financially responsible.

Can you buy a house with a 600 credit score VA loan?

Yes, you can get a VA loan with a 600 credit score, but getting approved may be more challenging, and you may have to pay a higher interest rate and/or provide a larger down payment. Lenders will also consider other factors, such as your income, debt-to-income ratio, and employment history, when determining your eligibility for a VA loan. It’s always best to improve your credit score before applying for a loan to increase your chances of approval and secure better terms.

Does getting your credit pulled by a lender hurt your score?

Yes, when a lender pulls your credit report, it can have a temporary negative impact on your credit score. This is because credit scoring models consider multiple credit inquiries within a short period of time as a sign of increased credit risk, which can lower your score. However, VA loan guidelines allow borrowers to shop around and get multiple rate quotes within a 30-day period without negatively affecting their credit score. This is known as a “rate shopping” period, and as long as all credit inquiries occur within the 30-day window, they will be treated as a single inquiry for scoring purposes.

What happens if you are denied based on credit?

If you are denied a VA loan based on bad credit, the lender must provide you with a written explanation of why you were denied. You can also request a free credit report to review the information the lender used to make the decision. In some cases, you can work with the lender to address any credit issues and reapply for the loan once your credit has improved. Alternatively, you may need to take steps to improve your credit on your own before applying for a VA loan again.

About Post Author